INTRODUCTION

Statistical Package for Social Sciences (SPSS) is one of the most

popular data analyses software packages used by academics. It use cuts across

all social sciences based disciplines hence, it important for all researchers

to understand how to use this great tool. SPSS is used for the analyses data

employing statistical methods like:

1) Simple and Multiple Regression Analyses; 2) Correlation Analyses;

(Part, Partial, Bi-variate, Multivariate etc); 3) Analyses of Variance; 4) Analyses of Co-Variance; 5) Neural Networks; and so many others we may

not be able to detail here.

This article is designed to show you how to use this great statistical

package to perform Simple Regression Analyses and Multiple Regression Analyses.

Finally, the article will show you how to interpret your results.

What is Regression?

Regression is a simple but powerful Statistical tool used for predicting or forecasting outcomes

and understanding the relationships between variables of a study.

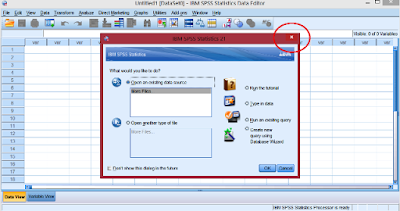

The first step in performing an analyses be it regression or

correlation analysis is to open the software user interface. We assume of

course that you have and understand the basics of your data-set. For example,

we assume that you understand the difference between dependent and independent

variables and have also been able to identify this in your data set. When you

open the user interface of SPSS from its icon on your computer, you should see

a screen like the one below:

This is the first screen that you see when you open the software every

time you want to use it. What you should do is to close the smaller inset

window from the button indicated by the red circle. From the window now

remaining you can now start your analysis.

SIMPLE REGRESSION

Simple

regression involves only two variables, the dependent and independent variables

Running Your Analysis

If you already have your data in another spreadsheet program like MS

Excel just copy and paste your data. When you are done entering your data,

click on the variable view close to the circled data view at the bottom left of

the screen. This will give the window below:

The first column captioned ‘Name’,

is by default filled in the first two rows with VAR00001 and VAR00002 given the

number of variables. VAR00001 is your dependent variable and VAR00002 is your

independent variable. Please rename as appropriate. For clarity sake, we give

them the hypothetical names GDP and FDI.

Please note that spaces are not allowed in renaming any of the

variables.

When you are done with the renaming, please go back to the data view

and observe that the columns with data has been re-captioned GDP and FDI from

VAR00001 and VAR0002 like it is shown below:

Now you are ready to perform the actual analyses and as the name

implies, find the tab at the top named:

Analyze and click on it as shown below:

When you

click on the highlighted 'linear' tab, the screen below will appear:

From the

window that is shown, highlight GDP and drag to the box captioned 'Dependent'.

Also highlight FDI and drag to the box marked 'independent'.

Now click on statistics in the same box, do you see any additional

features you want with your output?

If yes select it and proceed to 'options'

and select any appropriate options for you study. But it is advised that you

stick to the basic analysis in this first try.

When you are

done, now click on ‘OK’ at the

bottom of the screen like so .....

Now you have performed your first regression data analyses using SPSS - CONGRATULATIONS!

Specimen Output

Here is a

specimen of the result output:

Please note that the output shown below was copied to MS word

document.

Here is how to copy your result to word.

From the output screen shown, click on 'Edit', Scroll down and click on ‘Select all’. Now the entire result output is selected, go back and

click on 'Edit' again but this time

select 'Copy', wait a moment, now

open a word document and paste your result. Now you have your entire result as

shown in the specimen result output above:

Interpreting Your Results

Observe that the specimen result shown above has two pages with

different headings and captions. Here we chose to display only those parts of

the results that are useful to interpret a simple regression result. These are

the tables marked ‘Model Summary’

and ‘Coefficients’. The ‘Anova’ Table is not useful here and

hence will not feature for our interpretation.

In the ‘model summary’ table,

the first column is marked model and obviously given that we are working with

simple regression, there is only one model.

The second

column is marked 'R'. The R means

co-efficient of correlation which measure the strength of the relationship

between the variable under study.

Thus, the Co-efficient of Correlation (R) value of .430 means that the

strength of the relationship between GDP and FDI is 43 percent.

Column number three is named 'R

Square' also called Co-efficient of Determination or (R2). The

value given under it measures the extent or degree to which changes in FDI can

be relied on to explain the changes in GDP.

The value of 'R Square, (R2) value of .185 means that changes or flow

of FDI can only explain 18.5 percent of the changes in GDP.

Now we move

on to the next relevant output table, the one marked Coefficients.

The first column i this table is also named 'Model' and even though

there appear to be 2 models in the column, only one (the second one) is recognized.

The first model named constant is not recognized because in theory, its

interpretation makes little practical sense. So, we concentrate on the second

named FDI.

The second column captioned Unstandardized Coefficients is further

subdivided into 'B' and 'standard error'. First, the caption 'Unstandardized

Coefficients' indicates that the results are displayed without any form of

modification. Hence, if you used data that is in the same level of measurement

this is the data point you should use for your interpretation

For example, if your data set for GDP and FDI are measured in absolute

Naira or Dollar values, then you will use this column. On the other hand, if

one data set is in Absolute Naira or Dollar values and the other is in ratio,

then your interpretation should be based on the next column named Standardized

Coefficients

the

Standardized Coefficients column is adjusted to take into consideration the

fact that the two data sets are measured at different scales.

Since both

of our data sets are in absolute values, we shall use the UnStandardized

Coefficients column for our interpretation.

The column

named 'B' means coefficient of regression. This looks at the specific relationship

between the variables of the study. Here, the value says -.095 which means that

the specific relationship between FDI and GDP is negative. Implying that a 1

percent increase in FDI will lead to a 0.095 percent decrease in GDP and vice

versa.

Remeber, if

the data sets were in different measurement scales, we will use the same

process of interpretation but based on the column captioned 'Standardized

Coefficients'.

Now we go to

the next column marked 't'. This simply means the T-test and is used for test

of hypothesis.

The process here is to compare the t-value as shown in the output to

the the critical t-statistic table and the same degrees of freedom (DF). If the

output t-value is greater than or equal (≥)

to the critical t-value, the null hypothesis is rejected if not, do not reject

the null hypothesis.

In this case, the output t-value is 1.784 (ignoring the sign) and the

critical t-value @ 14DF and 0.05 level of significance is 2.14. From the

above, we can see that the critical t-value is greater than the output value

hence, we do no reject the null hypothesis. The implication of this result is

that FDI does not 'significantly' affect GDP.

Running Your Analysis

Essentially, the steps involved in analyzing a simple regression data

are the same. The major difference is that instead of a single independent

variable in the box you have 2 or more independent variables.

Here we have added another data column named 'DI' following the same steps

used in simple regression above.

Specimen Output

Here is the specimen output for a multiple regression analysis

involving 2 independent variables

Now, repeat

the same steps we used interpreting the FDI variable in the simple regression

above for the 'DI' variable.

the major difference here is that in the case of the simple regression

analysis, the model summary was only summarizing for a single independent

variable but in this case, it is summarizing for 2 independent variables that

is: FDI and FI but the concept remains the same.

Thus, in this case, we say that the strength of the relationship

between FDI, DI and GDP is .434 (43.4 percent) and FDI and DI taking as a unit

can only account for 18.9 change in GDP.

Looking at the co-efficient table, we note that FDI has a negative

relationship with GDP as shown earlier but 'DI' has a positive effect of .051

0n GDP. This implies that for every unit increase DI, GDP is expected to also

increase at 0.051 units.

Again, we

compare our output t-value to the critical t-table and use the same critiria as

above to accept or reject the null hypothesis.

The last column named 'sig' can be used on a stand-alone basis to

accept or reject the hypothesis without recourse to the t-table. in this case,

.493 and .818 are both greater than the acceptable significance level of 0.05

leading to an acceptance of the null hypothesis that there is no significant

relationship between FDI, DI and GDP.